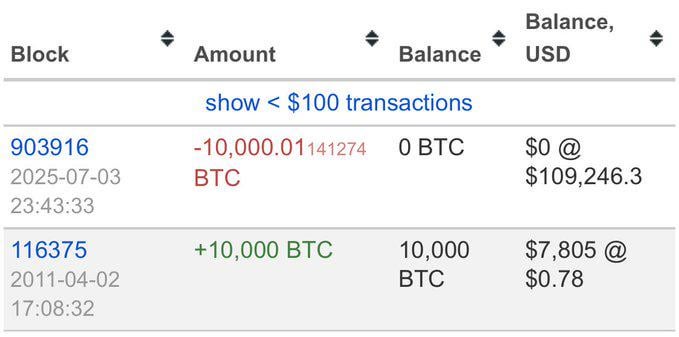

Imagine the balls it takes to not only hodl what is now $1.1 Billion worth of Bitcoin for 14 years from a $7800 cost basis, but to just send it all out with a single click and no test transaction.

Title: The $1.1B Bitcoin Transfer: How a 14-Year Hodl with “Balls of Steel” Made Crypto History

Meta Description: Discover the jaw-dropping story behind a Bitcoin whale who held $1.1B worth of BTC for 14 years (from a $7,800 investment) and shocked the world by sending it all—without a test transaction.

The Ultimate Bitcoin Hodl: From $7,800 to $1.1 Billion

Imagine buying Bitcoin in 2010 and forgetting about it for 14 years. Now imagine watching that modest investment turn into $1.1 billion. That’s the reality for an anonymous Bitcoin whale who just sent shockwaves through the crypto world—not only by revealing their staggering fortune but by moving all 18,000+ BTC in a single transaction with zero hesitation.

No test transaction. No incremental transfers. Just one click and poof—over a billion dollars changed hands.

This isn’t just a story about luck or timing. It’s a masterclass in diamond-handed conviction and the kind of nerve that redefines “balls of steel.” Here’s why this move left the crypto community stunned.

The Backstory: $7,800 to $1.1B In 14 Years

In 2010, Bitcoin traded for pennies. Early adopters could mine BTC on a laptop or buy thousands with pocket change. Our mystery whale invested roughly $7,800 into Bitcoin during this era, accumulating coins at an average cost basis of under $1 each.

Fast-forward to 2024:

- Bitcoin’s price soared to all-time highs near $70,000, valuing the stash at $1.1+ billion.

- 14 years of hodling through crashes, FUD, and endless “Bitcoin is dead” headlines.

- Zero withdrawals—just silent, immovable conviction.

This alone would make the holder legendary. But their exit strategy was even more audacious.

The Billion-Dollar Gamble: Skipping the Test Transaction

When moving large sums of crypto, especially Bitcoin, standard protocol is clear:

- Send a test transaction (e.g., $10 worth) to verify the recipient address.

- Confirm success before sending the rest.

- Avoid catastrophic errors like typos, incompatible wallets, or lost funds.

But this whale ignored all conventions. In one move—with a single on-chain transaction—they emptied their entire fortune to a new address. No tests. No second-guessing.

Why It’s Unthinkable:

- Human error risk: One mistyped character could mean losing $1B forever.

- Technical glitches: Software bugs, network congestion, or address incompatibility.

- Market impact: A $1B sell-off could crash prices, though the coins were moved, not sold.

Yet they did it anyway.

The Psychology of a Bitcoin Whale with “Balls of Steel”

What kind of person holds $1.1B in volatile, self-custodied assets for 14 years—then risks it all with one click?

1. Unshakeable Belief in Bitcoin

This whale survived Mt. Gox, China bans, the 2018 crash, and the 2022 bear market. Their resolve never wavered.

2. Next-Level Risk Tolerance

Sending $1B without a test transaction suggests:

- Extreme confidence in their technical setup.

- Indifference to conventional “best practices.”

- A mindset immune to fear of loss.

3. An Intentional Message to the Market?

Was this move a flex? A power play? Or just convenience? Whatever the motive, it broadcasts: “I don’t play by your rules.”

Lessons for Crypto Investors

-

Hodl Like a Titan

Long-term conviction pays—literally. A $1K investment in 2010 would now be worth over $100 million. -

Test Transactions Are Usually Essential

Unless you’re a billionaire with nerves of tungsten, always verify addresses with small amounts first. -

Self-Custody Matters

This fortune survived because the owner controlled their keys. Not your keys, not your coins.

Who Is the Mysterious Whale?

Speculation runs wild—is it Satoshi? An early miner? A collective? The truth remains unknown. But one thing’s certain: This story embodies Bitcoin’s ethos of sovereignty, risk, and relentless upside.

The Aftermath: What Happens Next?

The coins were moved to a new wallet, not sold. Does this signal:

- Ominous intentions (e.g., preparing to dump)?

- Cold storage upgrade (e.g., splitting funds for security)?

- Pure hodler trolling?

Only time will tell. But for now, the crypto world is left in awe of a legend who proved that sometimes, the biggest risks yield the greatest rewards.

Final Thought: Would you have the guts to hodl $1B in Bitcoin—and then move it all in one click?

Keywords: Bitcoin whale, $1.1B Bitcoin transfer, hodl Bitcoin, Bitcoin risk, crypto test transaction, Bitcoin 2010 investor, diamond hands.