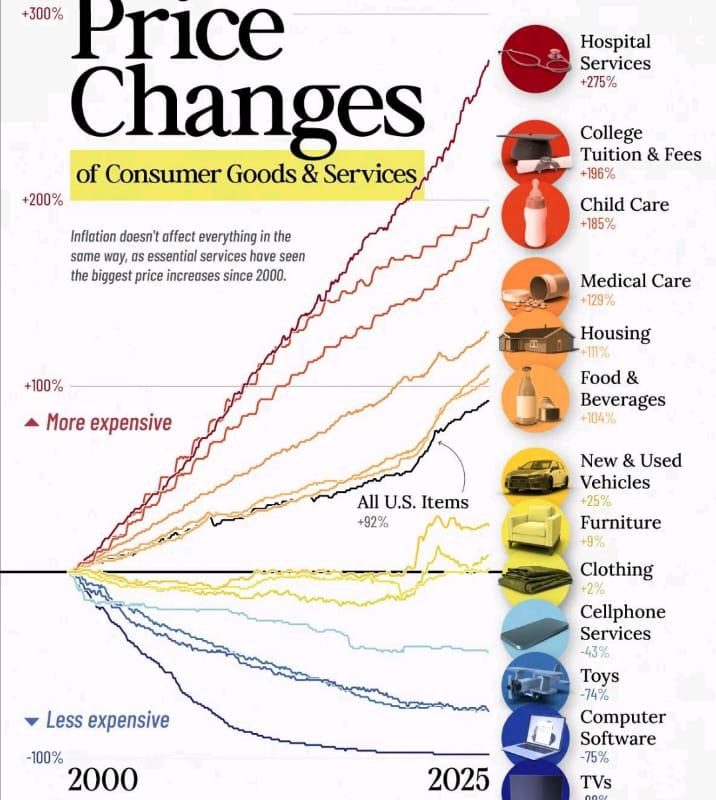

Price Changes 2000 to 2025

Title: Price Changes from 2000 to 2025: A Comprehensive Analysis of Inflation, Trends, and Projections

Meta Description: Explore how prices of goods, services, and assets have evolved since 2000, projected trends up to 2025, and the impact of inflation, global events, and economic policies.

Keywords: price changes 2000-2025, inflation trends, global price projections, economic forecasting, cost of living increase

Price Changes from 2000 to 2025: Understanding Inflation Across Decades

The 21st century has witnessed dramatic shifts in global prices, driven by technological advancements, geopolitical events, economic crises, and evolving consumer behavior. Understanding these price changes—from historical data to future projections—helps individuals, businesses, and policymakers prepare for economic challenges. Here’s a deep dive into price trends from 2000 to 2025 and the forces shaping them.

Section 1: Historical Price Trends (2000–2020)

2000–2007: The Pre-Crisis Boom

- Inflation Rate: Moderate global average (~2–3% yearly).

- Key Drivers:

- Technology: Prices for electronics (e.g., TVs, computers) fell due to rapid innovation and manufacturing efficiency.

- Energy: Oil prices rose steadily from $25/barrel (2000) to $100+ (2008), driven by growing demand from China and India.

- Housing: A global real estate bubble inflated prices, most notably in the U.S., Spain, and Ireland.

2008–2012: The Financial Crisis & Recovery

- Inflation Rate: Volatile, with temporary deflation in 2009.

- Impact of the Great Recession:

- Commodities: Oil prices collapsed from $147 to $30/barrel (2008–2009).

- Housing: U.S. home prices plummeted by ~30%, triggering foreclosures.

- Government Response: Quantitative easing (QE) programs kept interest rates low, fueling asset inflation by the early 2010s.

2013–2020: Stagnant Inflation & Disruption

- Low Inflation Era: Central banks struggled to hit 2% inflation targets despite low unemployment.

- Sector-Specific Shifts:

- Healthcare: U.S. medical costs rose ~80% cumulatively from 2000.

- Education: College tuition surged by 160% globally.

- Tech & Retail: E-commerce (e.g., Amazon) pushed retail prices lower, while streaming services disrupted media pricing.

Section 2: The Pandemic Shock (2020–2023)

The COVID-19 pandemic caused unprecedented supply chain disruptions and policy responses, reshaping global price dynamics:

- 2021–2022 Inflation Surge:

- Global inflation hit 7–9% (highest in 40 years).

- Causes: Supply shortages, pent-up demand, energy market volatility (Russia-Ukraine war), and stimulus spending.

- Housing & Food: U.S. home prices rose 40% (2020–2023), while food inflation exceeded 10% in 2022.

- Central Bank Response: Aggressive interest rate hikes (e.g., U.S. Federal Reserve) aimed to cool inflation but risked recession.

Section 3: Price Projections for 2023–2025

Economists anticipate a “new normal” of higher inflation compared to the 2010s, though stabilization is expected by 2025:

Key Influencing Factors:

- Geopolitics: Energy uncertainty (Middle East tensions, green transition).

- Wage Growth: Labor shortages could sustain service-sector inflation.

- Climate Change: Extreme weather disrupts agriculture, raising food prices.

- AI & Automation: Potential long-term deflation in manufacturing/logistics.

Sector-Specific Forecasts:

- Energy: Renewable energy costs will fall, but fossil fuel prices remain volatile.

- Housing: Markets may cool as interest rates stay elevated, but shortages persist.

- Food: Prices to stabilize but remain 10–15% above pre-pandemic averages.

- Technology: Gadgets and AI tools become cheaper, but data/privacy costs rise.

Regional Variations:

- Advanced Economies (U.S., EU): Inflation to soften to ~2.5–3.5% by 2025.

- Emerging Markets (India, Brazil): Faster growth may spur inflationary pressure (~4–6%).

Section 4: Implications for Consumers & Businesses

- Cost of Living: Households must budget for pricier essentials (food, housing, healthcare).

- Investment Strategy: Hedge against inflation with real estate, commodities, or TIPS (Treasury Inflation-Protected Securities).

- Business Adaptation: Supply chain resilience and automation are critical to managing input costs.

Conclusion: Navigating the Inflation Landscape

Price changes from 2000 to 2025 reveal a cycle of stability, crisis, and adaptation. While inflation may moderate in the coming years, structural shifts—like decarbonization, AI, and aging populations—will continue reshaping prices. Staying informed and flexible is key to thriving in this dynamic economic era.

FAQs

Q1: Why were prices stable from 2000–2020 despite crises?

Globalization and tech innovation offset inflationary pressures (e.g., cheap imports, automation).

Q2: Will prices ever return to pre-pandemic levels?

Unlikely—persistent wage growth and de-globalization suggest a higher baseline.

Q3: How can individuals protect savings from inflation?

Invest in diversified assets (stocks, real estate) rather than holding cash.

Q4: Which countries have the lowest projected inflation by 2025?

Switzerland, Japan, and Singapore due to strong currencies and stable demand.

Call to Action: Stay ahead of economic trends! Subscribe for monthly reports on inflation, markets, and global risks.